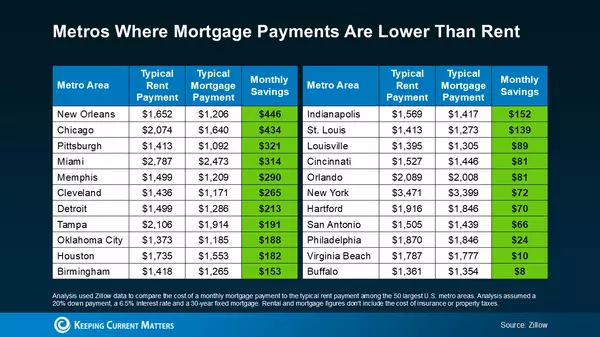

Is It Time to Buy? Rent vs. Mortgage Payments

Exciting news, homebuyers! In 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments, according to Zillow. With mortgage rates easing, home prices moderating, and inventory rising, affordability is improving. This means it’s getting cheaper to buy a home than to rent in many areas! 🎉 If your city isn’t on the list yet, don’t worry. Market conditions are shifting quickly, and your area could be next! Connecting with Krista Klause and her team, your trusted real estate professionals, can be a game-changer. They’ll help you stay informed and understand if what felt out of reach before is now within your budget. 📉💼 While buying comes with additional expenses like taxes, insurance, and maintenance, remember that renters face fees too—like insurance, parking, and utilities. Now’s the time to do the math and see where you stand. Could it be more affordable to buy than rent? Orphe Divounguy, Senior Economist at Zillow, says it best: “…for those who can make it work, homeownership may come with lower monthly costs and the ability to build long-term wealth in the form of home equity — something you lose out on as a renter.” With mortgage rates dropping and more homes hitting the market, now is a great time to connect with Krista Klause and start your home search. Whether you’re in one of these budget-friendly metros or anywhere in between, you don’t want to miss out! 🏡📲 Bottom LineIf you’re tired of renting and ready to see if homeownership is within reach, let’s chat! Krista Klause and her team are here to help you crunch the numbers and guide you through the process. Start building equity and enjoy the benefits of owning your own home today! 🌟👩💼👨💼

Read More

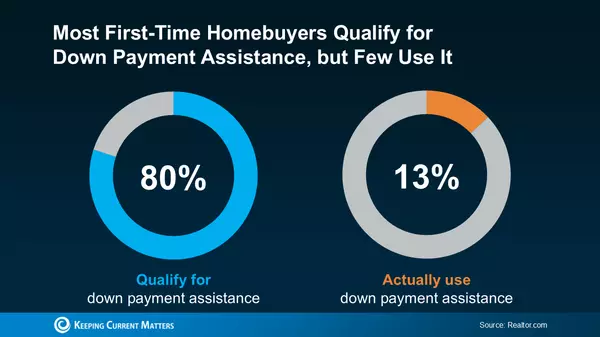

Unlock the Power of Down Payment Assistance with Krista Klause and Her Team!

Did you know almost 80% of first-time homebuyers qualify for down payment assistance, but only 13% take advantage of it? 😲 If you're looking to buy a home, this is a game-changer you need to know about! Maximize Your Down Payment Potential 💪 As a first-time buyer, there are so many resources available to help you reach your goal faster! From loan options that require as little as 3% down, or even 0% for Veterans, to grants and assistance programs that can cover some (or all!) of your down payment, the possibilities are endless. 💰 By exploring these options with a trusted lender, you could boost your down payment, which means a lower monthly mortgage payment and the chance to avoid or reduce extra costs like private mortgage insurance. 💸 Why leave money on the table? Don't Be Scared by Rising Down Payment Headlines! 😅 You might have seen headlines about rising down payments, but don’t worry! That doesn’t mean down payment requirements are going up. The average down payment is increasing because some buyers are putting more down to reduce their monthly payments, especially homeowners who are using their equity to buy their next home. So, first-time buyers—there’s no need to panic! Bottom Line: There’s help out there! 💡 Talk to Krista Klause and her team today to explore your options, connect with a trusted lender, and find out how you can take advantage of down payment assistance. Let’s get you into your dream home faster! 😊🏡

Read More

Unlock Your Dream Home Now: Mortgage Rates Have Dropped!

Exciting news for homebuyers! 🎉 Mortgage rates have dropped to their lowest point in over a year and a half, and it’s the perfect moment to make your move! If you’ve been waiting on the sidelines, this is your time to jump in and grab your dream home. Even a small dip in rates makes a big difference, but this recent drop is huge! Rates have fallen over half a percent 📉, giving you a chance for a better monthly payment. Imagine this: just a few months ago, a $400K loan at 7.5% meant a much higher payment. But now, with rates in the low 6s, you could save over $370 a month! 💸 That’s a game changer! Bottom Line: Your purchasing power is the best it’s been in nearly two years! 🌟 Don’t miss out on this opportunity. Reach out to Krista Klause and her team today to explore your options and make the most of these favorable rates! 🏠😊

Read More

The Best Time to Buy is Almost Here!

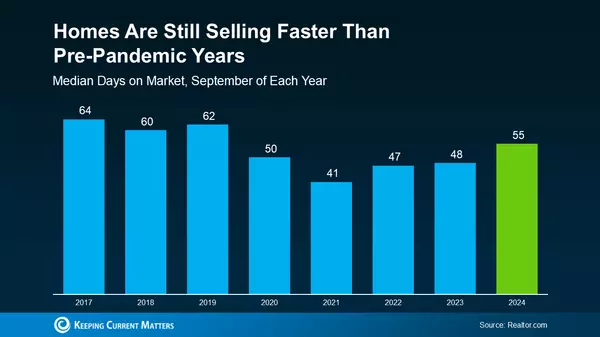

A shift is happening in the housing market, and now may be the perfect moment to jump back into your home search. According to Realtor.com, the best week to buy in 2024 is Sept. 29–Oct. 5. During this time, inventory is up, prices are below peak levels, and buyer demand is cooling, which means less competition for you! 📉 Why is This Week Special? Mortgage rates just hit their lowest point in 19 months, making homes more affordable. As Andy Walden from ICE says, the recent drop in rates has brought much-needed relief to homebuyers, making August the most affordable month since February. Additionally, Ralph McLaughlin of Realtor.com notes that inventory is up by 35.8%, giving you more options to find the right home. 🏠 What Does This Mean for You? With more homes on the market and motivated sellers eager to negotiate, you could find yourself in the perfect position to secure a great deal! Lower interest rates and a larger pool of homes to choose from make this fall a prime time to buy. ✨ Bottom Line: If you’ve been waiting for the right time to buy, Krista Klause and her team are ready to help you take advantage of this opportunity. Reach out today, and let’s get you off the sidelines and into your dream home! 😊📞

Read More

Categories

Recent Posts