What’s Really Happening with Home Prices?

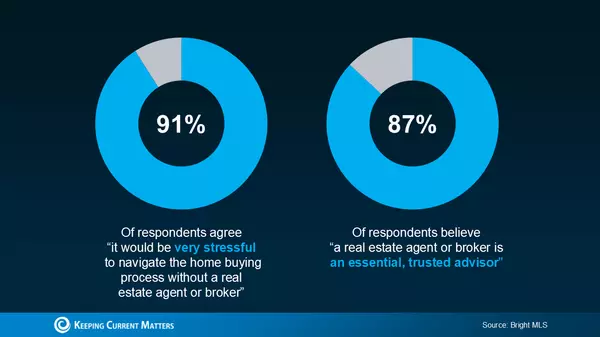

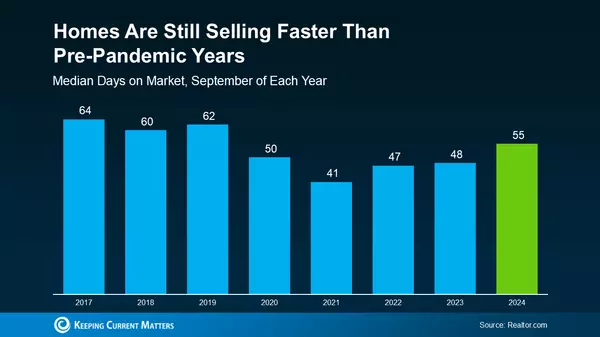

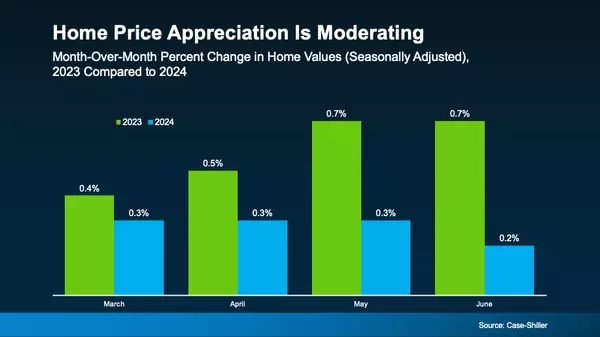

If you’ve been wondering about home prices lately, you’re not alone! With all the buzz out there, it can be hard to figure out your next move. 🤔 As a buyer, you might be worried about overpaying, and as a seller, you could be concerned about not getting your ideal price. Let’s break down what’s really going on with prices to help you make the right decision. Home Price Growth Is Slowing, But Prices Aren’t Dropping Across the country, home price appreciation is slowing down—meaning prices are still rising, just not as fast as in recent years. But don’t worry, this doesn’t mean home prices are dropping! The market is cooling, but prices are still on the rise, just at a more manageable pace. 📈 What’s Next for Home Prices? It’s All About Supply and Demand Where home prices go from here depends on supply and demand, and this can vary by local market. While the number of homes for sale is increasing, there still aren’t enough to fully meet buyer demand, keeping pressure on prices. As Danielle Hale, Chief Economist at Realtor.com, says: “. . . today’s low but quickly improving for-sale inventory has ushered in more market balance than would otherwise be expected. . . This should help home prices maintain a slower pace of growth.” Plus, with experts predicting a continued drop in mortgage rates, more buyers may enter the market soon, which could push prices even higher. 📉🏠 Why Work with a Local Real Estate Agent? National trends offer a broad view, but real estate is local. What’s happening in your neighborhood could be very different from the national average, depending on supply and demand in your market. That’s why working with a local expert like Krista Klause, your trusted realtor, is so important. Whether you’re buying or selling, Krista and her team can give you the latest data and help you make the best decision for your unique situation. They’ll help you price your home accurately or find the perfect property that fits your budget. Bottom Line Home prices are still rising, just at a slower pace. Whether you’re buying, selling, or just curious about your home’s value, reach out to Krista Klause and her team today for expert advice and personalized guidance! 😊📞

Read More

September Shift: What a Fed Rate Cut Means for You and the Housing Market!

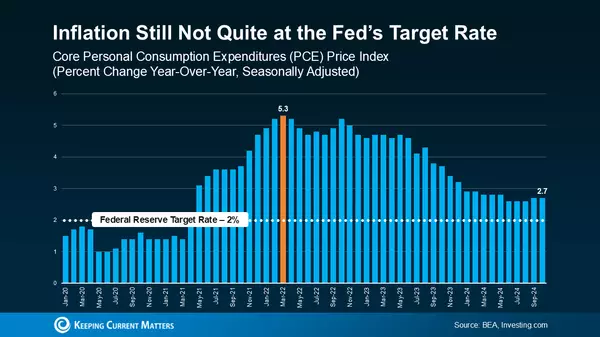

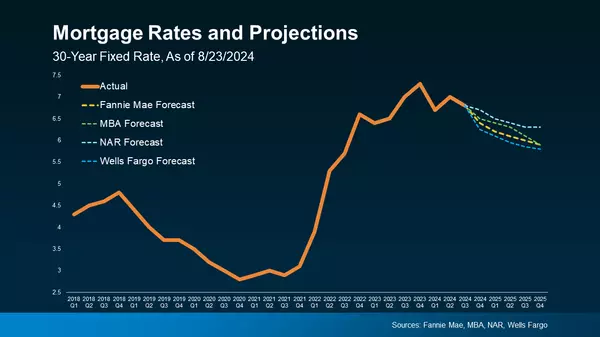

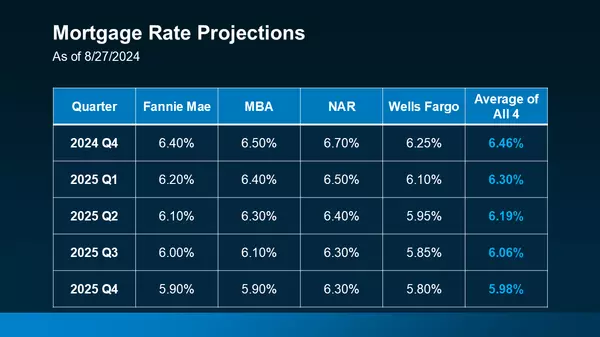

As September rolls in, all eyes are on the Federal Reserve (the Fed). With inflation cooling and the job market slowing, many expect a cut to the Federal Funds Rate at their upcoming meeting. Mark Zandi, Chief Economist at Moody’s Analytics, believes they’re ready: “They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.” But what does this mean for the housing market and, more importantly, for you as a potential homebuyer or seller? Why a Federal Funds Rate Cut Matters The Federal Funds Rate influences mortgage rates, along with other factors like the economy and geopolitical events. When the Fed cuts this rate, mortgage rates often respond. While one cut might not cause a dramatic drop, it could contribute to the gradual decline already underway. Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), explains: “Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.” And this likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), suggests: “Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.” The Impact on Mortgage Rates Experts project that mortgage rates will continue to decline gradually through 2025, partly due to anticipated Fed cuts. Here’s why this is good news for buyers and sellers: Easing the Lock-In Effect: For current homeowners, lower mortgage rates could ease the lock-in effect, where higher rates make people hesitant to sell. A slight rate reduction might make selling more attractive, though it’s unlikely to flood the market with sellers. Boosting Buyer Activity: For potential homebuyers, lower rates make homeownership more affordable, potentially encouraging more people to enter the market. What Should You Do? While a Fed rate cut is unlikely to lead to drastically lower mortgage rates, it’s a step in the right direction. However, as Jacob Channel, Senior Economist at LendingTree, wisely notes: “Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.” Bottom Line The expected Fed rate cut, driven by improving inflation and slower job growth, is likely to have a gradual positive impact on mortgage rates, unlocking opportunities for you. When you’re ready to explore your options, connect with Krista Klause and her team to make informed decisions and take action! 😊📞

Read More

Embrace Your Next Chapter: Discover the Perks of 55+ Communities with Krista Klause!

If you’re thinking about downsizing, you might be curious about 55+ communities and whether they’re the right fit for you. Here’s some information to help you decide! 😊🏡 What Is a 55+ Community? 🤔 These communities aren’t just for those needing extra support—they can be vibrant, active places full of like-minded individuals. Many people choose this type of home because they want to be surrounded by others in a similar stage of life. U.S. News describes it perfectly: “The terms ‘55-plus community,’ ‘active adult community,’ ‘lifestyle communities,’ and ‘planned communities’ refer to a setting that caters to the needs and preferences of adults over the age of 55. These communities are designed for seniors who can care for themselves but may want to downsize to a community with others their same age and with similar interests.” Why Consider a 55+ Community? 🏘️ If this sounds like something you’d enjoy, here’s something to think about: the options for 55+ communities are growing! According to 55places.com, the number of listings for homebuyers in this age group has increased by over 50% compared to last year. More choices mean you’re more likely to find a home that perfectly fits your needs, making your move smoother and less stressful. 🌟 Other Benefits of 55+ Communities 🎉 These communities offer several perks: Lower-Maintenance Living: Say goodbye to mowing the lawn or pulling weeds! Many 55+ communities handle maintenance, so you can focus on enjoying life. 🌷 On-Site Amenities: From fitness centers to clubhouses, these communities often feature amenities that make it easy to stay active and social. Some even have media rooms, libraries, spas, and arts and crafts studios! 🎨💪 Like-Minded Neighbors: Enjoy clubs, outings, and meet-ups that foster a close-knit, friendly community. 👫 Accessible Floor Plans: Many homes offer first-floor living, ample storage, and modern layouts tailored to this phase of life. 🏠 Bottom Line 💬 If a 55+ community sounds appealing, reach out to a local real estate agent. Krista Klause, your trusted realtor, can guide you through the available options in your area and help you find the perfect home with the amenities you’re looking for. You may discover that a 55+ home is exactly what you’ve been searching for! 😊🏡 Contact Krista Klause today to explore your options and make your downsizing journey a breeze! 📞✨

Read More

2025 Housing Market Outlook: What You Need to Know to Make Your Best Move!

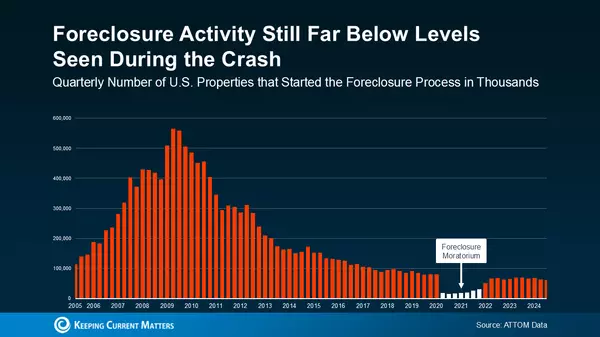

Looking ahead to 2025, it's crucial to understand what experts are predicting for the housing market. Whether you're thinking about buying or selling a home next year, having a clear picture of the market outlook can help you make the best decisions for your homeownership goals. 🏡✨ Here's a sneak peek at the most recent projections on mortgage rates, home sales, and prices for 2025. Mortgage Rates Are Projected To Come Down Slightly 📉 Mortgage rates play a significant role in shaping the housing market. According to forecasts from Fannie Mae, the Mortgage Bankers Association (MBA), the National Association of Realtors (NAR), and Wells Fargo, we can expect a gradual decline in mortgage rates throughout the next year. Why the expected drop? It’s largely due to the easing of inflation and a slight rise in unemployment rates—key indicators of a strong but slowing economy. Many experts believe these signs will encourage the Federal Reserve to lower the Federal Funds Rate, which typically leads to lower mortgage rates. As Morgan Stanley puts it: “With the U.S. Federal Reserve widely expected to begin cutting its benchmark interest rate in 2024, mortgage rates could drop as well—at least slightly.” Expect More Homes To Sell 🏘️ The market is likely to see an increase in both the supply of homes available and a rise in demand, as more buyers and sellers who’ve been holding off due to higher rates decide it’s time to make a move. This is one of the main reasons why experts are predicting an increase in home sales next year. According to Fannie Mae, MBA, and NAR, total home sales are expected to rise slightly, with around 5.4 million homes projected to sell in 2025. That’s a modest increase from the lower sales numbers we’ve seen in 2023 and 2024. For perspective, about 4.8 million homes were sold in 2023, and expectations are for approximately 4.5 million homes to sell this year. While slightly lower mortgage rates may not cause a massive surge in buyers and sellers, they will likely encourage more activity in the market. This means more homes available for sale and healthy competition among buyers eager to make a purchase. Home Prices Will Go Up Moderately 📈 As more buyers jump into the market, we'll see continued upward pressure on prices. According to the latest price forecasts from 10 trusted real estate sources, home prices are expected to rise nationally by an average of 2.6% next year. Although there’s a range of opinions on how much prices will climb, experts agree that home prices will continue to increase moderately in 2025 at a slower, more sustainable rate. Keep in mind, however, that prices will always vary by local market. Bottom Line 💬 Understanding the housing market forecasts for 2025 can help you plan your next move with confidence. Whether you're buying or selling, staying informed about these trends ensures you make the best decision possible. If you’re ready to discuss how these projections might impact your plans, contact Krista Klause and her team—they’d love to help! 😊📞 Let's make 2025 your best year yet in real estate! 🎉

Read More

Categories

Recent Posts