Understanding Mortgage Rates: A Guide by Krista Klause, Your San Antonio Realtor

🔑 Insights from Krista Klause, San Antonio and Surrounding Areas Real Estate Expert 🔑

If you're in the San Antonio area looking to buy a home, staying informed about mortgage rates is crucial. Here's a breakdown of what influences these rates:

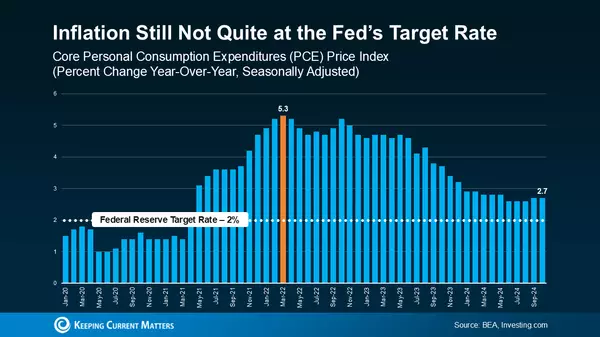

Inflation and the Federal Reserve 🏛️💹

The Federal Reserve (Fed) plays a key role, though it doesn't set mortgage rates directly. The Fed adjusts the Federal Funds Rate in response to inflation and economic indicators. This impacts mortgage rates, as Business Insider explains. Recently, the Fed's rate hikes to combat inflation have led to higher mortgage rates. However, Danielle Hale from Realtor.com predicts easing rates in 2024 as inflation improves.

The 10-Year Treasury Yield 📈

Mortgage companies also consider the 10-Year Treasury Yield when setting interest rates. If the yield increases, so do mortgage rates, and vice versa. Investopedia notes that while there's traditionally been a consistent spread between the Treasury Yield and mortgage rates, recent fluctuations suggest potential for rates to drop.

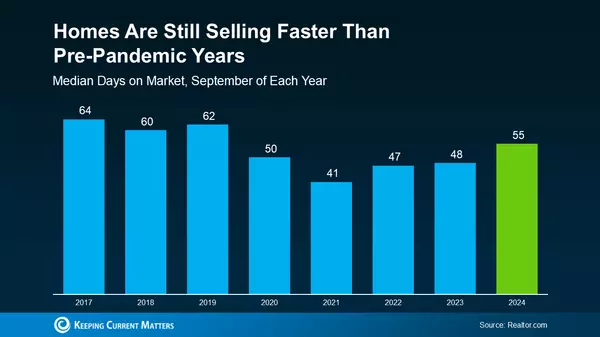

Current Market Outlook 🌍

With the upcoming Fed meeting, industry experts are closely watching for any decisions and their effects on the economy. It's an important time for San Antonio homebuyers to stay updated.

Bottom Line 🔑

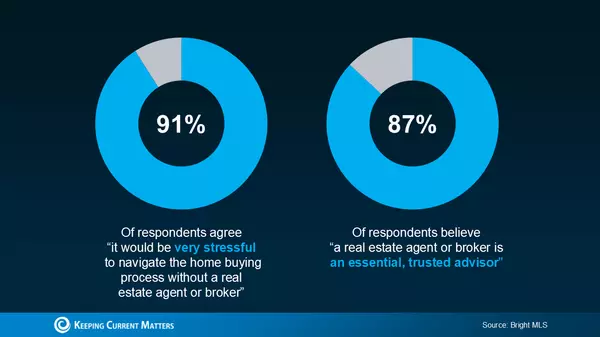

As mortgage rates fluctuate, it's beneficial to have a knowledgeable team to guide you through your home buying journey in San Antonio and surrounding areas.

📞 For expert real estate advice and updates on mortgage rates in San Antonio, contact Krista Klause.

Categories

Recent Posts