Unlock the American Dream: How VA Home Loans Make Homeownership Possible for Veterans

For over 79 years, Veterans Affairs (VA) home loans have helped countless Veterans achieve the dream of homeownership 🏡🇺🇸. However, according to Veterans United, only 3 in 10 Veterans realize they may be able to buy a home without needing a down payment 🤔💸. That’s why it’s so important for Veterans—and anyone who cares about a Veteran—to be aware of this valuable program. Knowing about available resources can make the path to homeownership smoother and keep life-changing plans from being put on hold. Veterans United explains it best: “The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.” The Advantages of VA Home Loans VA home loans are specifically designed to make homeownership accessible for those who have bravely served our country 🎖️. Here are some of the standout benefits, according to the Department of Veterans Affairs: Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all, making it simpler to get started on your homebuying journey 🙌💰. Limited Closing Costs: VA loans limit the types of closing costs Veterans have to pay, helping keep more money in your pocket when it’s time to close the deal 💼🖋️. No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI—even with lower down payments—leading to lower monthly payments and substantial savings over time 💸📉. Your team of expert real estate professionals, including Krista Klause and her team, along with a trusted lender, are the best resources to help you understand all the options and advantages available to reach your homebuying goals 🎯🏠. Bottom Line Owning a home is a key part of the American Dream, and VA home loans are an incredible benefit for those who’ve served our country 🇺🇸. Work with a real estate professional like Krista Klause to ensure you have everything you need to make confident decisions in the housing market. Reach out today to see how Krista Klause and her team can assist with your real estate needs! ✨

Read More

Understanding the Fed’s Role in the Housing Market

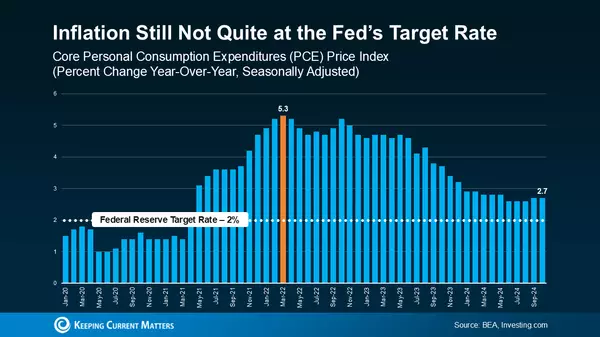

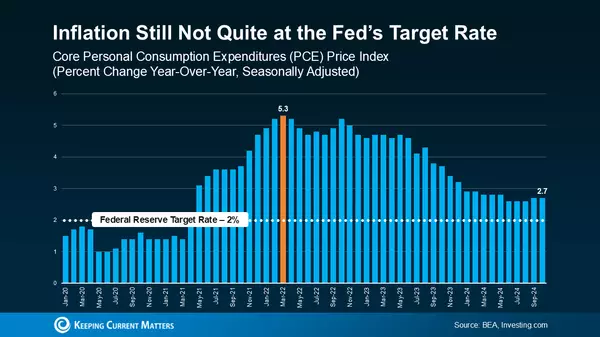

With all the talk about the Federal Reserve (the Fed) and its impact on the housing market, it’s important to know what’s really going on. This week, the Fed meets to discuss the Federal Funds Rate—essentially, the cost for banks to borrow from one another. While this isn’t directly setting mortgage rates, it does influence them, so buyers and sellers should take note. Krista Klause and her team are here to help you break down how this affects you 📉💼. What Drives the Fed’s Decisions? The Fed considers three main economic indicators: Inflation 📈Inflation has been high recently, but it’s showing signs of stabilizing as it moves closer to the Fed’s 2% target. Lower inflation could lead to rate cuts soon, which may eventually ease mortgage rates too. Job Growth 💼The Fed is monitoring how many new jobs are added each month, and the numbers are beginning to cool, which is exactly what the Fed aims for. Fewer jobs mean a slower economy, which could lead to rate cuts. Unemployment RateA strong labor market is reflected in a low unemployment rate of 4.1%, showing the Fed’s current strategy is balancing out well. What’s Next for Mortgage Rates? If the Fed lowers the Federal Funds Rate, mortgage rates could follow over time. Experts anticipate a gradual decline in rates as we move into 2024 and 2025, but it won’t happen overnight. Key economic events, including the upcoming presidential election, could still cause market shifts and impact rate trends. Bottom Line 💬 While the Fed’s decisions are important, it’s economic data and market trends that truly drive mortgage rates. Partner with Krista Klause and her team to navigate this changing landscape and find opportunities as rates gradually stabilize. The journey may include some twists, but with the right team, you’ll have a trusted guide every step of the way!

Read More

Navigating Today’s Housing Market with Confidence

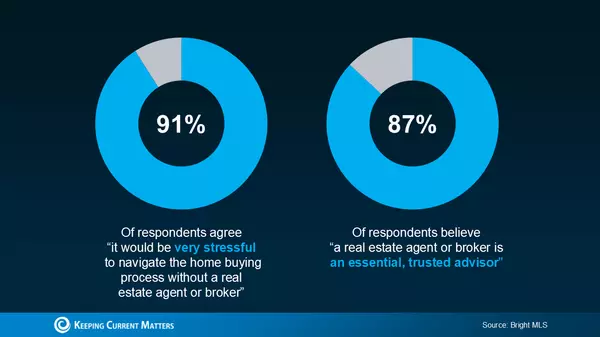

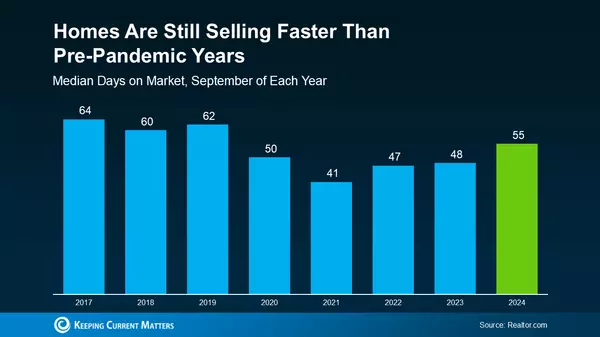

If you’re thinking about making a move, you’ve probably noticed the housing market feels a bit unpredictable right now. From mortgage rates to home prices, volatility is real – but understanding why can help you move forward with confidence. What’s Driving Today’s Market Volatility? Factors like economic data, job numbers, Federal Reserve decisions, and even the upcoming election add uncertainty, which often leads to market swings. This can especially impact mortgage rates, which tend to shift as new reports and global events unfold. Although experts predict rates may drop over time, sudden changes can happen as Greg McBride, Chief Financial Analyst at Bankrate, says: “After steadily declining throughout the summer months, I expect more ups and downs to mortgage rates…” The takeaway? Mortgage rates and home prices may not follow a straight line. For example, while some markets see prices rising and tight inventory, others experience more availability and moderated prices. Why Partner with a Pro? With shifts in the road ahead, having an expert like Krista Klause and her team makes all the difference! They’ll keep you informed on every market turn, helping you make smart decisions based on your goals. And as rates and prices shift, they’ll work with trusted lenders to ensure you understand how it affects your bottom line. Whether it’s navigating local competition, understanding inventory, or strategizing on price, Krista Klause and her team have you covered. 🏡✨ Bottom Line: The market may have its bumps, but don’t let that hold you back! With the support of Krista Klause and a dedicated team, you can navigate the changes with confidence and make the most of every opportunity.

Read More

No Foreclosure Wave in Sight: What You Need to Know About Today’s Housing Market

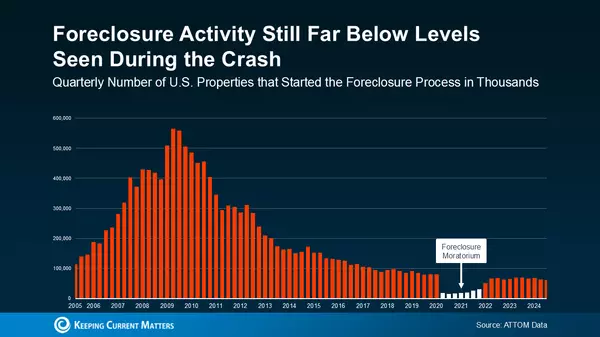

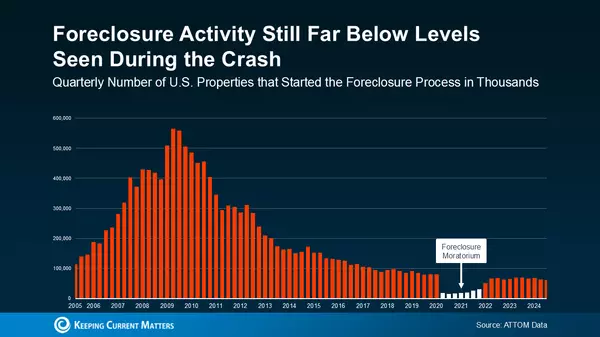

With rising costs, many people worry that homeowners might struggle with mortgage payments, leading to a surge in foreclosures. But before hitting the panic button, let’s look at the facts. The latest data shows no wave of foreclosures on the horizon, and today's market is much stronger than the 2008 crash. Unlike 2008, homeowners now have significant equity in their homes. This equity acts as a safety net, allowing those facing financial hardships to sell their homes rather than fall into foreclosure. While foreclosure filings have ticked up slightly since 2020, this is largely due to the end of a temporary moratorium. Overall, filings are still much lower than during the housing crash. In short, today’s homeowners are in a much better position than before, thanks to higher equity and more options to avoid foreclosure. Bottom Line: Rising costs don’t mean we’re facing another foreclosure crisis. If you're concerned about the housing market, reach out to Krista Klause and her team, your go-to real estate experts, for guidance! 👩💼💼

Read More

Categories

Recent Posts