First-Time Home Buyer

Essential Advice for First-Time Home Buyers

Entering the housing market for the first time can be both exciting and overwhelming. From finding the perfect property to navigating the mortgage process, there are numerous factors to consider. To help you make informed decisions, we have compiled some essential advice for first-time home buyers.

For Buyers:

1. Prioritize Your Needs: Start by making a list of your wants and needs in a home. Consider factors such as location, size, number of bedrooms, and proximity to schools or work. This will help you narrow down your search and focus on properties that meet your criteria.

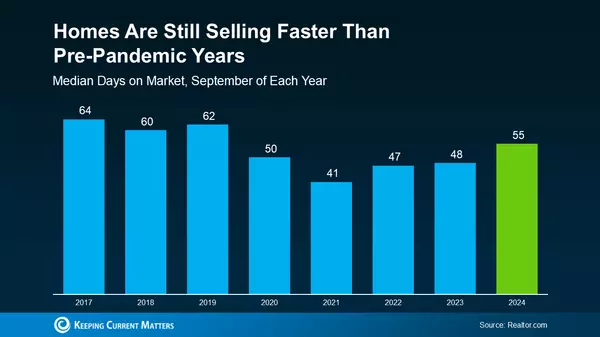

2. Research the Market: Conduct thorough research on the local real estate market. Understand the current trends, average property prices, and the type of properties available in your desired area. This knowledge will enable you to make competitive offers and negotiate effectively.

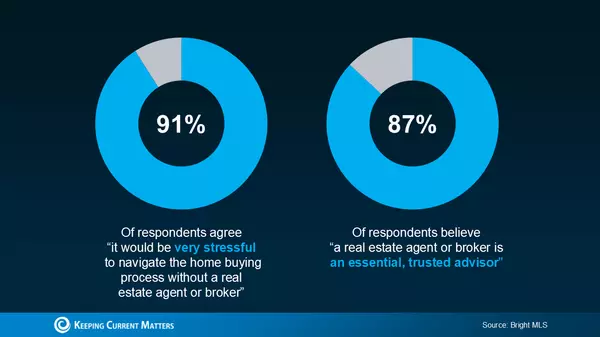

3. Work with a Knowledgeable Realtor: Engaging a reliable and experienced real estate agent is crucial. They can guide you throughout the home buying process, provide valuable insights, and negotiate on your behalf. Look for an agent who understands your needs and has a good track record in the market.

For Sellers:

1. Prepare Your Home: If you are selling your property, it is essential to make it attractive to potential buyers. Consider making necessary repairs, decluttering, and staging the home to maximize its appeal. A well-presented property often sells faster and at a better price.

2. Price It Right: Setting the right asking price is crucial. Overpricing can discourage potential buyers, while underpricing may result in a financial loss. Collaborate with your real estate agent to determine an optimal price based on market conditions, recent sales, and unique features of your property.

3. Market Effectively: Utilize various marketing channels to reach a wider audience. Online listings, professional photography, virtual tours, and open houses are effective ways to showcase your property. A comprehensive marketing strategy will help attract potential buyers and increase your chances of a successful sale.

For Mortgage:

1. Determine Your Budget: Before starting your home search, assess your financial situation and determine how much you can afford. Consider your current income, savings, and existing debts. Use online calculators or consult with a mortgage professional to estimate your budget.

2. Get Pre-Approved: Obtaining a mortgage pre-approval will give you a clear understanding of your borrowing capacity. This process involves submitting your financial documents to a lender who will then assess your eligibility. Having a pre-approval letter in hand will make your offers stronger and more credible to sellers.

3. Compare Lenders: Shop around and compare mortgage offers from different lenders to ensure you secure the best terms and interest rates. Consider factors such as loan types, interest rates, fees, and customer service. Don't hesitate to ask questions and seek professional advice to make an informed decision.

Remember, buying a home is a significant investment, and careful planning is key. By following these essential tips, you can navigate the housing market with confidence and find the perfect home that meets your needs and budget. Good luck on your journey as a first-time home buyer!

Categories

Recent Posts