Mortgage Rates Are Dropping: Is Now the Time to Buy?

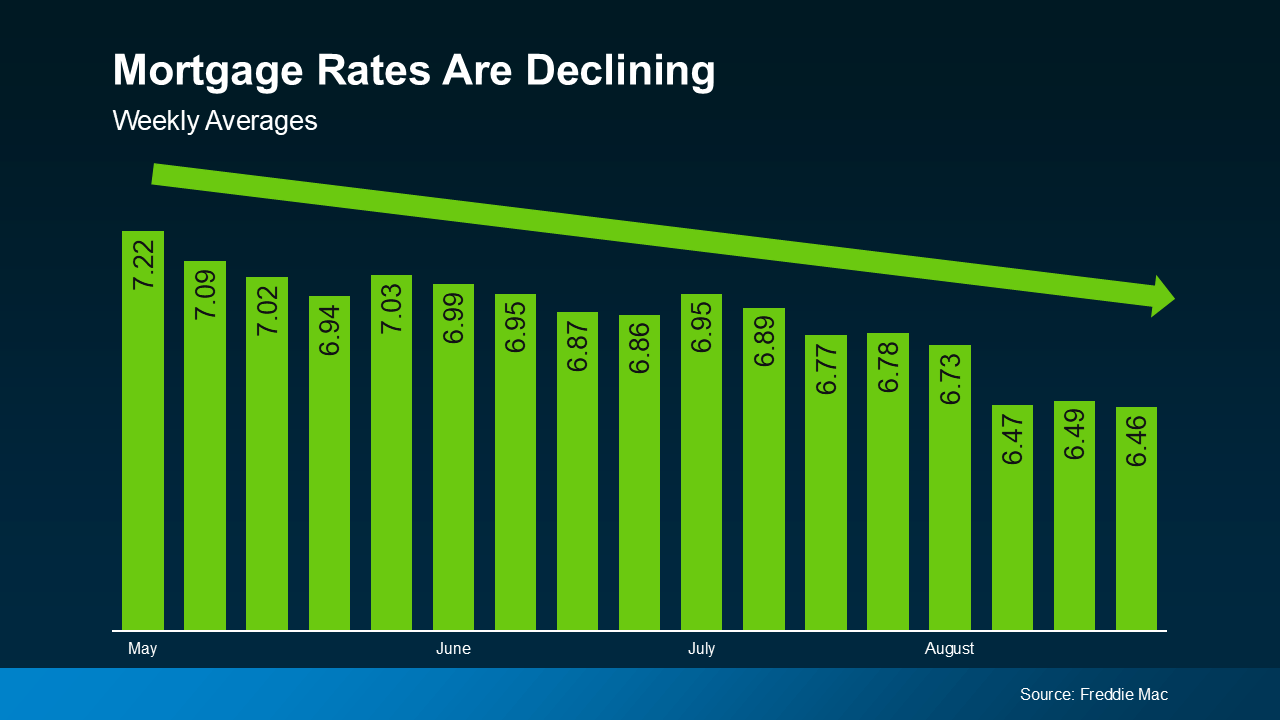

You won’t find anyone who’s going to argue that mortgage rates have had a big impact on housing affordability over the past couple of years. But there is hope on the horizon! Rates have actually started to come down, and recently, they hit the lowest point we’ve seen in 2024, according to Freddie Mac. 📉

If you’re thinking about buying a home, you might be wondering: how much lower are they going to go? Here’s some info to help you know what to expect.

Expert Projections for Mortgage Rates 📊

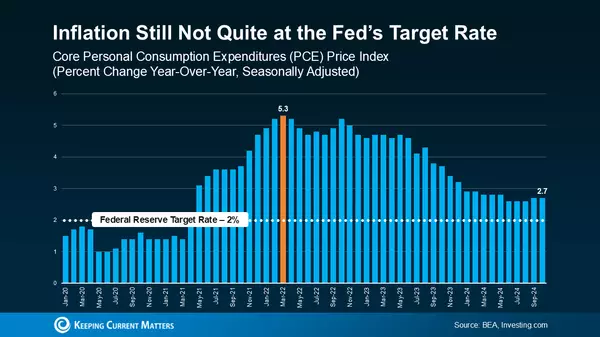

Experts say the overall downward trend should continue as long as inflation and the economy keep cooling. But expect some ups and downs as new reports come out. The key is not to get distracted by the blips—focus on the larger trend. Rates are down roughly a full percentage point from the recent peak in May, and many experts believe rates in the low 6s are possible in the months ahead.

Most experts are even revising their 2024 mortgage rate forecasts to be more optimistic. For instance, Realtor.com now expects a yearly mortgage rate average of 6.7%, with a year-end forecast of 6.3%.

Know Your Number for Mortgage Rates 🔢

What does this mean for you and your plans to move? If you’ve been holding out and waiting for rates to come down, know that it’s already happening. The question is: what number are you comfortable with?

Maybe it’s 6.25%, 6.0%, or even 5.99%. Once you have that number in mind, you don’t need to follow rates yourself—let me do that for you! I’ll keep you updated on the latest trends and let you know when it’s time to make your move.

Bottom Line 🏠

If higher mortgage rates have put your moving plans on hold, now’s the time to think about the rate that would bring you back into the market. Once you have that number in mind, reach out to Krista Klause, your trusted go-to Realtor, and I’ll be by your side to help you navigate the journey. Contact my team and me, and we’ll be happy to assist you! 😊✨

Categories

Recent Posts