September Shift: What a Fed Rate Cut Means for You and the Housing Market!

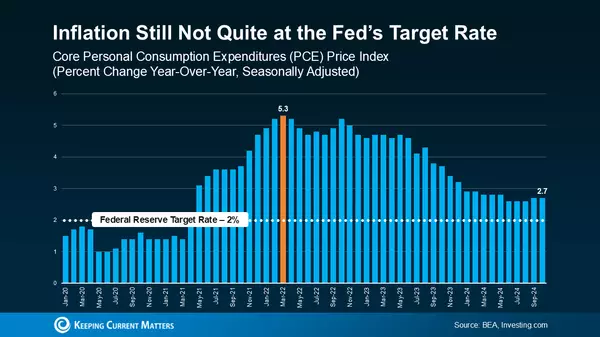

As September rolls in, all eyes are on the Federal Reserve (the Fed). With inflation cooling and the job market slowing, many expect a cut to the Federal Funds Rate at their upcoming meeting. Mark Zandi, Chief Economist at Moody’s Analytics, believes they’re ready:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market and, more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate influences mortgage rates, along with other factors like the economy and geopolitical events. When the Fed cuts this rate, mortgage rates often respond. While one cut might not cause a dramatic drop, it could contribute to the gradual decline already underway. Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), explains:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And this likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), suggests:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

The Impact on Mortgage Rates

Experts project that mortgage rates will continue to decline gradually through 2025, partly due to anticipated Fed cuts. Here’s why this is good news for buyers and sellers:

-

Easing the Lock-In Effect: For current homeowners, lower mortgage rates could ease the lock-in effect, where higher rates make people hesitant to sell. A slight rate reduction might make selling more attractive, though it’s unlikely to flood the market with sellers.

-

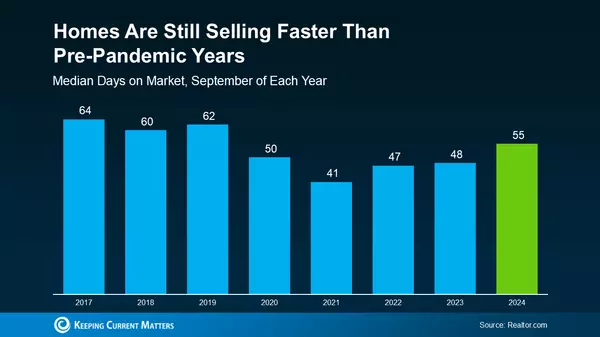

Boosting Buyer Activity: For potential homebuyers, lower rates make homeownership more affordable, potentially encouraging more people to enter the market.

What Should You Do?

While a Fed rate cut is unlikely to lead to drastically lower mortgage rates, it’s a step in the right direction. However, as Jacob Channel, Senior Economist at LendingTree, wisely notes:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Bottom Line

The expected Fed rate cut, driven by improving inflation and slower job growth, is likely to have a gradual positive impact on mortgage rates, unlocking opportunities for you. When you’re ready to explore your options, connect with Krista Klause and her team to make informed decisions and take action! 😊📞

Categories

Recent Posts