How Homeowners Win When They Downsize

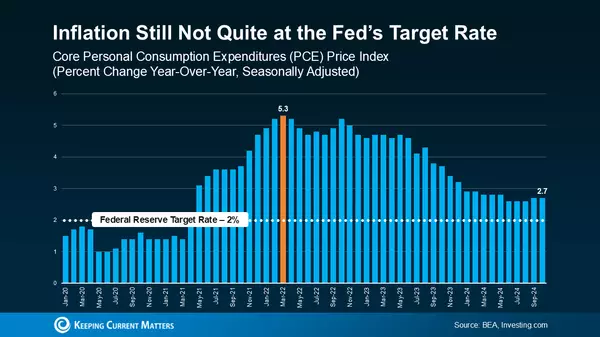

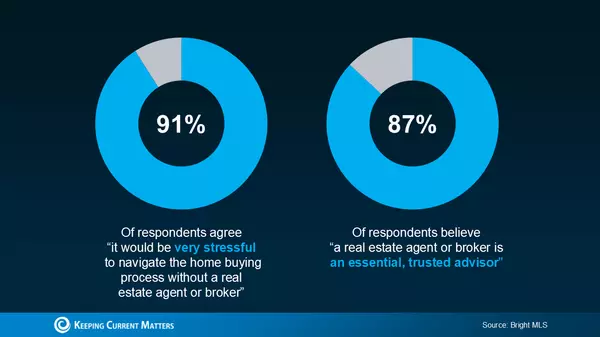

Downsizing has long been a popular option when homeowners reach retirement age. But there are plenty of other life changes that could make downsizing worthwhile. Homeowners who have experienced a change in their lives or no longer feel like their house fits their needs may benefit from downsizing too. U.S. News explains:“Downsizing is somewhat common among older people and retirees who no longer have children living at home. But these days, younger people are also looking to downsize to save money on housing . . .”And when inflation has made most things significantly more expensive, saving money where you can has a lot of appeal. So, if you’re thinking about ways to budget differently, it could be worthwhile to take your home into consideration.When you think about cutting down on your spending, odds are you think of frequent purchases, like groceries and other goods. But when you downsize your house, you often end up downsizing the bills that come with it, like your mortgage payment, energy costs, and maintenance requirements. Realtor.com shares:“A smaller home typically means lower bills and less upkeep. Then there’s the potential windfall that comes from selling your larger home and buying something smaller.”That windfall is thanks to your home equity. If you’ve been in your house for a while, odds are you’ve developed a considerable amount of equity. Your home equity is an asset you can use to help you buy a home that better suits your needs today.And when you’re ready to make a move, your team of real estate experts will be your guides through every step of the process. That includes setting the right price for your house when you sell, finding the best location and size for your next home, and understanding what you can afford at today’s mortgage rate.What This Means for YouIf you’re thinking about downsizing, ask yourself these questions:Do the original reasons I bought my current house still stand, or have my needs changed since then?Do I really need and want the space I have right now, or could somewhere smaller be a better fit?What are my housing expenses right now, and how much do I want to try to save by downsizing?Once you know the answers to these questions, meet with a real estate advisor to get an answer to this one: What are my options in the market right now? A local housing market professional can walk you through how much equity you have in your house and how it positions you to win when you downsize.SBottom LineIf you’re looking to save money, downsizing your home could be a great help toward your goal. Talk with a real estate agent about your goals in the housing market this year.

Read More

How Changing Mortgage Rates Can Affect You

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power. The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down.What This Means for YouYou may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains:“It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

Read More

Is It Really Better To Rent Than To Own a Home Right Now?

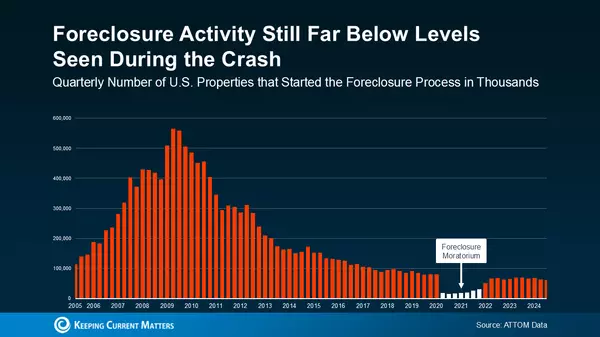

You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on.A lot of the time, these reports are assuming things that aren’t realistic for the average household. For example, the methodology behind one of those reports says that renting is the smarter financial option because of the opportunity to invest money elsewhere. It assumes renters take the money they’d spend on costs tied to buying a home and put it in an investment portfolio.But here’s the thing – most people who rent aren’t making those investments. Ken Johnson, Co-Author of the BH&J National Price-to-Rent Index, explains:“One of the difficulties with the rent and reinvest model is many people . . . simply rent and spend the difference. . . . That’s wealth destroying.”The reason homeownership is one of the best investments you can make is the wealth it helps you build. That’s why there’s a significant difference between the net worth of the average homeowner and the average renter (see graph below):So, before you renew your rental agreement, think about the opportunity to build wealth that homeownership provides.Bottom LineIf you’re unsure whether to continue renting or to buy a home, let’s connect to help you make the best decision.

Read More

Why are you paying your landlords mortgage and not your own?

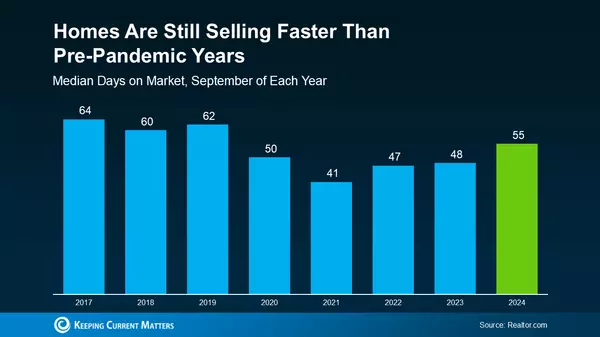

Avoid the Rental Trap in 2023 If you’re a renter, you likely face an important decision every year: renew your current lease, start a new one, or buy a home. This year is no different. But before you dive too deeply into your options, it helps to understand the true costs of renting moving forward. In the past year, both current renters and new renters have seen their rent go up based on information from realtor.com: “Three out of four renters (74.2%) who have moved in the past 12 months reported seeing their rent increase. The strain from recent rent hikes isn’t exclusive to renters who have recently moved. Nearly two-thirds of renters (63.2%) who have lived in their current rental between 12 and 24 months, and likely renewed their lease, have also reported increases in their rent.” And if you look back at historical data, that shouldn’t come as surprise. That’s because, according to the Census, rents have been rising fairly consistently since 1988 (see graph below): So, if you’re considering renting as an option in 2023, it’s worth weighing whether this trend is likely to continue. The 2023 Housing Forecast from realtor.com expects rents will keep climbing (see graph below): That forecast projects rents will increase by 6.3% in the year ahead (shown in green). When compared to the blue bars in the graph, it’s clear that the 2023 projection doesn’t call for an increase as drastic as the ones renters have seen over the past two years, but it’s still above the historical average for rent hikes between 2013-2019. That means, if you’re planning to rent again this year and you’ve not yet renewed your lease, you may pay more when you do. Homeownership Provides an Alternative to Rising Rents These rising costs may make you reconsider what other alternatives you have. If you're looking for more stability, it could be time to prioritize homeownership. One of the many benefits of owning your own home is it provides a stable monthly cost that you can lock in for the duration of your loan. As Freddie Mac says: “Monthly rent payments may increase over time, but a fixed-rate mortgage will ensure that you're paying the same amount each month. With a fixed-rate mortgage, your interest rate is locked in for the life of loan. Steady payments allow you to budget wisely and make plans for the future.” If you’re planning to make a move this year, locking in your monthly housing costs for the duration of your loan can be a major benefit. You’ll avoid wondering if you’ll need to adjust your budget to account for annual increases like you would if you left your housing payment up to your landlord and their renewal cycle. Homeowners also enjoy the added benefit of home equity, which has grown substantially. In fact, the latest Homeowner Equity Insight report from CoreLogic shows the average homeowner gained $34,300 in equity over the last 12 months. As a renter, your rent payment only covers the cost of your dwelling. When you pay your mortgage on a house, you grow your wealth through the forced savings that is your home equity. Bottom Line If you’re thinking of renting this year, it’s important to keep in mind the true costs you’ll face. Let’s chat to see how you can begin your journey to homeownership today. 4 Things Every Renter Needs To Consider As a renter, you’re constantly faced with the same dilemma: keep renting for another year or purchase a home? Your answer depends on your current situation and future plans, but there are a number of benefits to homeownership every renter needs to consider. Here are a few things you should think about before you settle on renting for another year. 1. Rents Are Rising Quickly Rent increasing each year isn’t new. Looking back at Census data confirms rental prices have gone up consistently for decades (see graph below):If you’re a renter, you’re faced with payments that continue to climb each year. Realtor.com recently shared the September Rental Report, and it shows price increases accelerating from August to September (see graph below):As the graph shows, rents are still on the rise. It’s important to keep this in mind when the time comes for you to sign a new lease, as your monthly rental payment may increase substantially when you do. 2. Renters Miss Out on Equity Gains One of the most significant advantages of buying a home is the wealth you build through equity. This year alone, homeowners gained a substantial amount of equity, which, in turn, grew their net worth. As a renter, you miss out on this wealth-building tool that can be used to fund your retirement, buy a bigger home, downsize, or even achieve personal goals like paying for an education or starting a new business. 3. Homeowners Can Customize to Their Heart’s Content This is a big decision-making point if you want to be able to paint, renovate, and make home upgrades. In many cases, your property owner determines these selections and prefers you don’t alter them as a renter. As a homeowner, you have the freedom to decorate and personalize your home to truly make it your own. 4. Owning a Home May Provide Greater Mobility than You Think You may choose to rent because you feel it provides greater flexibility if you need to move for any reason. While it’s true that selling a home may take more time than finding a new rental, it’s important to note how quickly houses are selling in today’s market. According to the National Association of Realtors (NAR), the average home is only on the market for 17 days. That means you may have more flexibility than you think if you need to relocate as a homeowner. Bottom Line Deciding if it’s the right time for you to buy is a personal decision, and the timing is different for everyone. However, if you’d like to learn more about the benefits of homeownership, let’s connect so you can make a confident, informed decision and have a trusted advisor along the way. Renters Missed Out on $51,500 This Past Year Rents have increased significantly this year. The latest National Rent Report from Apartmentlist.com shows rents are rising at a rate much higher than the three years leading up to the pandemic: “Since January of this year, the national median rent has increased by a staggering 16.4 percent. To put that in context, rent growth from January to September averaged just 3.4 percent in the pre-pandemic years from 2017-2019.” Looking back, we can see rents rising isn’t new. The median rental price has increased consistently over the past 33 years (see graph below):If you’re thinking of renting for another year, consider that rents will likely be even higher next year. But that alone doesn’t paint the picture of the true cost of renting. The Money Renters Stand To Lose This Year A homeowner’s monthly mortgage payment pays for their shelter, but it also acts as an investment. That investment grows in the form of equity as a homeowner makes their mortgage payment each month to pay down what they owe on their home loan. Their equity gets an additional boost from home price appreciation, which is at near-record levels this year. The latest Homeowner Equity Insights report from CoreLogic found homeowners gained significant wealth through their home equity this past year. The research shows: “. . . the average homeowner gained approximately $51,500 in equity during the past year.” As a renter, you don’t get the same benefit. Your rent payment only covers the cost of shelter and any included amenities. None of your monthly rent payments come back to you as an investment. That means, by renting this year, you likely paid more in rent than you did in the previous year, and you also missed out on the potential wealth gain of $51,500 you could have had by owning your own home. Bottom Line When deciding whether you should rent or buy in the future, keep in mind how much renting can cost you. Another year of renting is another year you’ll pay rising rents and miss out on building your wealth through home equity. Let’s connect today to talk more about the benefits of buying over renting.

Read More

Categories

Recent Posts