Trying To Buy a Home? Hang in There.

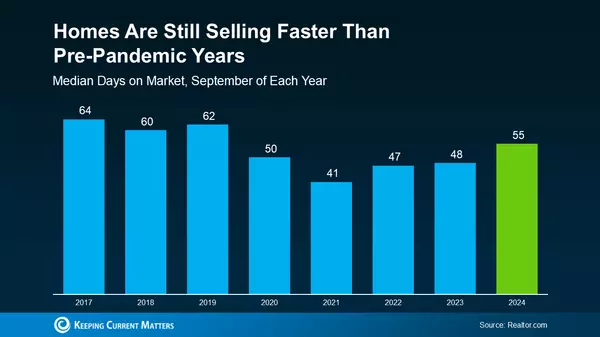

We’re still in a sellers’ market. And if you’re looking to buy a home, that means you’re likely facing some unique challenges, like difficulty finding a home and volatile mortgage rates. But keep in mind, there are some benefits to being a buyer in today’s market that give you good reason to stick with your search. Here are a few of them.Long-Term Benefits Outweigh Short-Term ChallengesOwning a home grows your net worth – and since building that wealth takes time, it makes sense to start as soon as you can. If you wait to buy and keep renting, you’ll miss out on those monthly housing payments going toward your home equity. Freddie Mac puts it this way:“Homeownership not only builds a sense of pride and accomplishment, but it’s also an important step toward achieving long-term financial stability.”The key there is long-term because the financial benefits homeownership provides, like home value appreciation and equity, grow over time. Those benefits are worth the short-term challenges today’s sellers’ market presents.Mortgage Rates Are Constantly ChangingMortgage rates have been hovering around 6.5% over the last several months. However, as Sam Khater, Chief Economist at Freddie Mac, notes, they’ve been coming down some recently:“Economic uncertainty continues to bring mortgage rates down. Over the last several weeks, declining rates have brought borrowers back to the market . . .”Lower mortgage rates improve your purchasing power when you buy, and that can help make homeownership more affordable. Hannah Jones, Economic Data Analyst at realtor.com, explains:“As we move into the spring buying season, mortgage rates have ticked lower, a welcomed sign of progress towards affordability.”The recent drop in mortgage rates is good news if you couldn’t afford to buy a home when they peaked.Home Prices Will IncreaseAccording to the Home Price Expectation Survey, which polls over 100 real estate experts, home values will go up steadily over the next few years after a slight decline this year (see graph below):Rising home prices in the coming years means two things for you as a buyer:Waiting to buy a home could mean it’ll become more expensive to do so.Buying now means the value of your home, and your net worth, will likely grow over time.

Read More

Why Aren’t Home Prices Crashing?

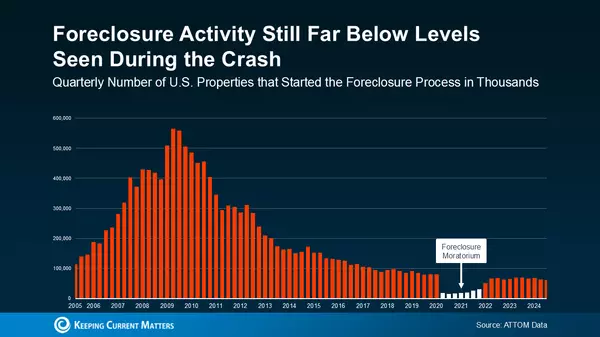

There have been a lot of shifts in the housing market recently. Mortgage rates rose dramatically last year, impacting many people’s ability to buy a home. And after several years of rapid price appreciation, home prices finally peaked last summer. These changes led to a rise in headlines saying prices would end up crashing.Even though we’re no longer seeing the buyer frenzy that drove home values up during the pandemic, prices have been relatively flat at the national level. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), doesn’t expect that to change:“[H]ome prices will be steady in most parts of the country with a minor change in the national median home price.”You might think sellers would have to lower prices to attract buyers in today’s market, and that’s part of why some may have been waiting for prices to come crashing down. But there’s another factor at play – low inventory. And according to Yun, that’s limiting just how low prices will go:“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”As you can see in the graph below, we’ve been at or near record-low inventory levels for a few years now.That lack of available homes on the market is putting upward pressure on prices. Bankrate puts it like this:“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”If more homes don’t come to the market, a lack of supply will keep prices from crashing, and, according to industry expert Rick Sharga, inventory isn’t likely to rise significantly this year:“I believe that we’re likely to see low inventory continue to vex the housing market throughout 2023.”Sellers are under no pressure to move since they have plenty of equity right now. That equity acts as a cushion for homeowners, lowering the chances of distressed sales like foreclosures and short sales. And with many homeowners locked into low mortgage rates, that equity cushion isn’t going anywhere soon.With so few homes available for sale today, it’s important to work with a trusted real estate agent who understands your local area and can navigate the current market volatility.

Read More

How Changing Mortgage Rates Can Affect You

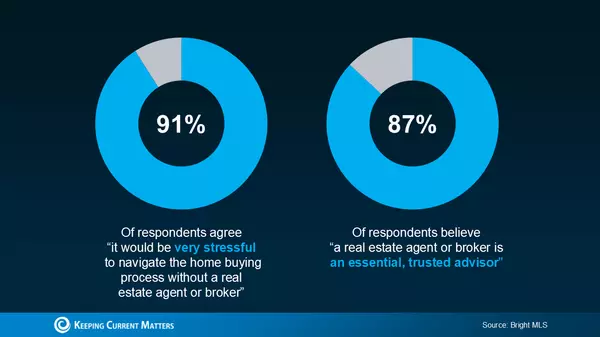

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power. The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down.What This Means for YouYou may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains:“It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

Read More

![Facts About Closing Costs [INFOGRAPHIC],KCM Crew](https://cdn.chime.me/image/fs/sitebuild/2019929/2/w600_original_a1f10ff7-5f3f-45de-9863-cdc3a16f5198-jpeg.webp)

Facts About Closing Costs [INFOGRAPHIC]

Read More

Categories

Recent Posts