Understanding Down Payment Assistance with Krista Klause

Buying a home has become more challenging with today's mortgage rates and home price appreciation. Many homebuyers are eager to explore grants and assistance programs but don't know where to start. A recent Bank of America Institute study found that 53% of prospective buyers need help understanding homebuying grant programs. Here’s some information to help you navigate these options. What Is Down Payment Assistance? Down Payment Assistance (DPA) programs offer loans and grants that can cover part or all of a home buyer’s down payment and closing costs. 🏠 More than 2,000 programs are available nationwide. Many homebuyers could be eligible for thousands of dollars in assistance. Plus, you might not need to save as much for your down payment as you think. Contrary to popular belief, a 20% down payment is not always necessary. 🎉 First-Time and Repeat Buyers Are Often Eligible It’s not just first-time homebuyers who can benefit from these programs. Over 39% of homeownership programs are for repeat buyers who have owned a home in the last three years. 🚪 Additional Down Payment Resources Here are some programs helping buyers achieve homeownership: Teacher Next Door: Assists teachers, first responders, health providers, government employees, active-duty military personnel, and Veterans. Fannie Mae: Provides down payment assistance to eligible first-time homebuyers in majority-Latino communities. Freddie Mac: Offers options for buyers with modest credit scores and limited funds for a down payment. 3By30 Program: Aims to add 3 million new Black homeowners by 2030. Native American Programs: Highlights 42 homebuyer assistance programs across 14 states. For more information on these programs, contact a trusted real estate professional. They can share details about available options, including federal, state, and local programs tailored to specific professions or communities. 🏡 Bottom Line Affordability remains a challenge, so take advantage of all available resources. Connect with a team of real estate professionals, including a trusted lender and local agent, to explore your options. 🌟 For personalized advice and expert guidance, reach out to Krista Klause, your trusted realtor.

Read More

Don’t Be Misled by Headlines: Understanding Home Prices in Today’s Market

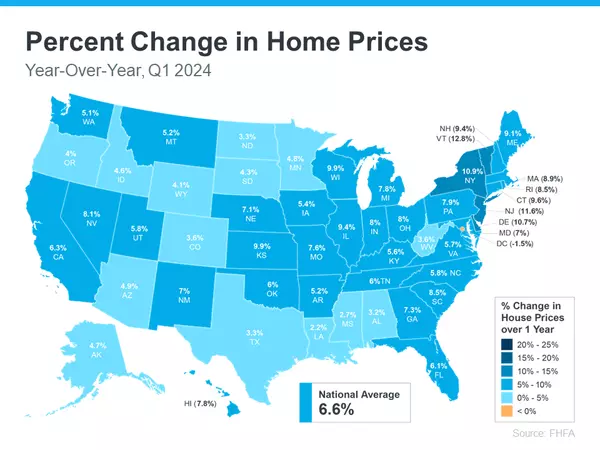

Hello, I’m Krista Klause, your trusted realtor. If you’ve seen the news lately about home sellers slashing prices, it’s a great example of how headlines do more to terrify than clarify. Here’s what’s really happening with prices. 🏠 📊 The Big Picture on Home Prices The bottom line is that home prices are higher than they were a year ago, and they’re expected to keep rising, just at a slower pace. 📈 But a recent article from Redfin notes: “Price Drops Hit Highest Level in 18 Months As High Rates Dampen Buyer Demand.” 📉 And that might make you think prices are declining. Now, while it’s true the latest report from Realtor.com shows 16.6% of homes on the market had price reductions in May (up from 12.7% last May), that doesn’t mean overall home prices are falling. 🚫 The key is knowing the difference between the asking price and the sold price. 🤔 🏡 Understanding Asking Price vs. Sold Price In essence, the asking price, also known as a listing price, is the amount a seller hopes to get for their home when they list it. In reality, sellers can’t just put any price tag on their house and expect it to sell for top dollar. 🏷️ Today’s buyers are savvy, and when they aren’t willing to pay a premium for a home because their budgets are strained by higher mortgage rates, sellers need to adjust. And that’s what’s happening right now. 💡 Based on market factors and the offers that sellers receive, the asking price can change. If a seller isn’t getting much foot traffic, you may see them revise the price and make an adjustment to reignite interest in the home – and sometimes that’s because they’ve overpriced it from the start. That’s where price reductions come in, and when you see “price drops” in a headline, it sounds like declining home prices. 📉 Mike Simonsen, CEO and Founder of Altos Research, says: “Not only is the share of homes with price cuts elevated compared to one year ago, but more price cuts are happening each week than last year.” On the other hand, the final sold price is the amount a buyer actually pays when the transaction is complete. 💸 Here’s the most important thing to note: Actual sold prices are still rising, and they’re expected to continue to do so at least over the next 5 years. 📈 🧐 What Does This Mean for Home Prices? So, while there’s been an increase in price reductions recently, this doesn’t mean overall home values are declining. Instead, it’s a sign that demand is moderating. And, as a result, sellers are adjusting their expectations to align with today’s market reality. 🌍 Even with more price reductions, home values are still growing on an annual basis, as they do nearly every year in the housing market. According to the Federal Housing Finance Agency (FHFA), home prices went up 6.6% over the last year. 📅 This map shows how prices rose just about everywhere in the country, indicating the market is not in decline. 🗺️ So, while seller price reductions are often a leading indicator that prices may moderate in the months ahead, which experts have been saying for a while is expected to happen, they aren’t necessarily reason for alarm. 🚨 The same article from Redfin also states: “. . .those metrics suggest sale-price growth could soften in the coming months as persistently high mortgage rates turn off homebuyers. For now, the median-home sale price is up 4.3% year over year to another record high. . .” And with inventory as tight as it is today, price moderation is much more likely in upcoming months than price declines. 📉 🌟 Why This Is Good News for Buyers and Sellers For buyers, more realistic asking prices mean a better chance of securing a home at a fair price. It also means you can enter the market with more confidence, knowing prices are stabilizing rather than continuing to skyrocket. 🏡 For sellers, understanding the need to adjust your asking price can lead to faster sales and fewer price negotiations. Setting a realistic price from the start can attract more serious buyers and lead to smoother transactions. 🤝 🔍 Bottom Line While the uptick in price reductions might seem troubling, it’s not a cause for concern. It reflects a market adjusting to new conditions. Home prices are continuing to grow, just at a more moderate pace. 🌟 If you have any questions or need personalized advice, feel free to reach out to me, Krista Klause, your trusted realtor. 😊👩💼 📞 Contact Krista Klause Today!

Read More

First-Time Home Buyer

Essential Advice for First-Time Home Buyers Entering the housing market for the first time can be both exciting and overwhelming. From finding the perfect property to navigating the mortgage process, there are numerous factors to consider. To help you make informed decisions, we have compiled some essential advice for first-time home buyers. For Buyers: 1. Prioritize Your Needs: Start by making a list of your wants and needs in a home. Consider factors such as location, size, number of bedrooms, and proximity to schools or work. This will help you narrow down your search and focus on properties that meet your criteria. 2. Research the Market: Conduct thorough research on the local real estate market. Understand the current trends, average property prices, and the type of properties available in your desired area. This knowledge will enable you to make competitive offers and negotiate effectively. 3. Work with a Knowledgeable Realtor: Engaging a reliable and experienced real estate agent is crucial. They can guide you throughout the home buying process, provide valuable insights, and negotiate on your behalf. Look for an agent who understands your needs and has a good track record in the market. For Sellers: 1. Prepare Your Home: If you are selling your property, it is essential to make it attractive to potential buyers. Consider making necessary repairs, decluttering, and staging the home to maximize its appeal. A well-presented property often sells faster and at a better price. 2. Price It Right: Setting the right asking price is crucial. Overpricing can discourage potential buyers, while underpricing may result in a financial loss. Collaborate with your real estate agent to determine an optimal price based on market conditions, recent sales, and unique features of your property. 3. Market Effectively: Utilize various marketing channels to reach a wider audience. Online listings, professional photography, virtual tours, and open houses are effective ways to showcase your property. A comprehensive marketing strategy will help attract potential buyers and increase your chances of a successful sale. For Mortgage: 1. Determine Your Budget: Before starting your home search, assess your financial situation and determine how much you can afford. Consider your current income, savings, and existing debts. Use online calculators or consult with a mortgage professional to estimate your budget. 2. Get Pre-Approved: Obtaining a mortgage pre-approval will give you a clear understanding of your borrowing capacity. This process involves submitting your financial documents to a lender who will then assess your eligibility. Having a pre-approval letter in hand will make your offers stronger and more credible to sellers. 3. Compare Lenders: Shop around and compare mortgage offers from different lenders to ensure you secure the best terms and interest rates. Consider factors such as loan types, interest rates, fees, and customer service. Don't hesitate to ask questions and seek professional advice to make an informed decision. Remember, buying a home is a significant investment, and careful planning is key. By following these essential tips, you can navigate the housing market with confidence and find the perfect home that meets your needs and budget. Good luck on your journey as a first-time home buyer!

Read More

Navigating the Busy June Housing Market with Krista Klause, Your Trusted Realtor

June marks one of the busiest months in the real estate calendar, as many people aim to buy or sell homes. Whether you're buying or selling, here's what you need to know to navigate this vibrant market successfully. If You're Buying This June 🏠 The end of the school year sparks a flurry of activity in the housing market, making late spring and early summer a peak time for transactions. If you're looking to buy: Be Prepared for Competition: With more buyers on the hunt, expect to face stiff competition. More homes are listed during this season, providing you with more options but also more challengers for each property 📈. Work with a Pro: Having a real estate agent like Krista Klause on your side is crucial. She can provide the latest listings and expert advice on crafting competitive offers and evaluating properties fairly to ensure you make wise decisions 🌟. If You're Selling This June 🏡 This is an advantageous time to sell due to the high buyer demand: Capitalize on Buyer Urgency: Many buyers are eager to settle before the new school year, which may lead to quicker sales or better offers for your home 🚀. Price Smartly and Prepare Well: Ensure your home is in tip-top condition and priced correctly to attract serious buyers quickly. A well-presented home in line with market value is more likely to fetch a better price ⚖️. Stay Flexible with Closing Dates: Be ready to negotiate on closing timelines to accommodate buyers' needs, such as aligning with the school calendar or the sale of their current home. Flexibility can lead to favorable terms, such as covering closing costs or additional concessions 🗓️. Bottom Line Whether you're buying or selling, June's dynamic market requires strategic planning and expert guidance. Talk to Krista Klause to navigate this bustling period effectively. With her expertise, you can maximize your opportunities in this competitive season 🌟

Read More

Categories

Recent Posts