Embrace Your Next Chapter: Discover the Perks of 55+ Communities with Krista Klause!

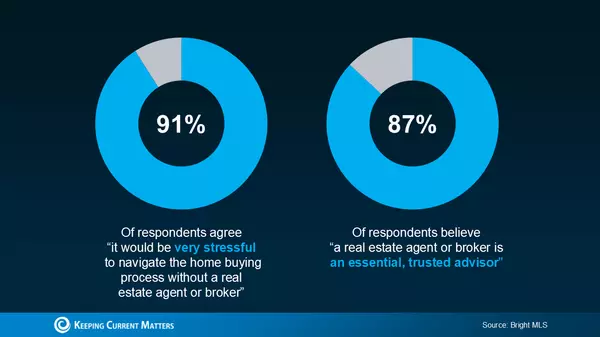

If you’re thinking about downsizing, you might be curious about 55+ communities and whether they’re the right fit for you. Here’s some information to help you decide! 😊🏡 What Is a 55+ Community? 🤔 These communities aren’t just for those needing extra support—they can be vibrant, active places full of like-minded individuals. Many people choose this type of home because they want to be surrounded by others in a similar stage of life. U.S. News describes it perfectly: “The terms ‘55-plus community,’ ‘active adult community,’ ‘lifestyle communities,’ and ‘planned communities’ refer to a setting that caters to the needs and preferences of adults over the age of 55. These communities are designed for seniors who can care for themselves but may want to downsize to a community with others their same age and with similar interests.” Why Consider a 55+ Community? 🏘️ If this sounds like something you’d enjoy, here’s something to think about: the options for 55+ communities are growing! According to 55places.com, the number of listings for homebuyers in this age group has increased by over 50% compared to last year. More choices mean you’re more likely to find a home that perfectly fits your needs, making your move smoother and less stressful. 🌟 Other Benefits of 55+ Communities 🎉 These communities offer several perks: Lower-Maintenance Living: Say goodbye to mowing the lawn or pulling weeds! Many 55+ communities handle maintenance, so you can focus on enjoying life. 🌷 On-Site Amenities: From fitness centers to clubhouses, these communities often feature amenities that make it easy to stay active and social. Some even have media rooms, libraries, spas, and arts and crafts studios! 🎨💪 Like-Minded Neighbors: Enjoy clubs, outings, and meet-ups that foster a close-knit, friendly community. 👫 Accessible Floor Plans: Many homes offer first-floor living, ample storage, and modern layouts tailored to this phase of life. 🏠 Bottom Line 💬 If a 55+ community sounds appealing, reach out to a local real estate agent. Krista Klause, your trusted realtor, can guide you through the available options in your area and help you find the perfect home with the amenities you’re looking for. You may discover that a 55+ home is exactly what you’ve been searching for! 😊🏡 Contact Krista Klause today to explore your options and make your downsizing journey a breeze! 📞✨

Read More

2025 Housing Market Outlook: What You Need to Know to Make Your Best Move!

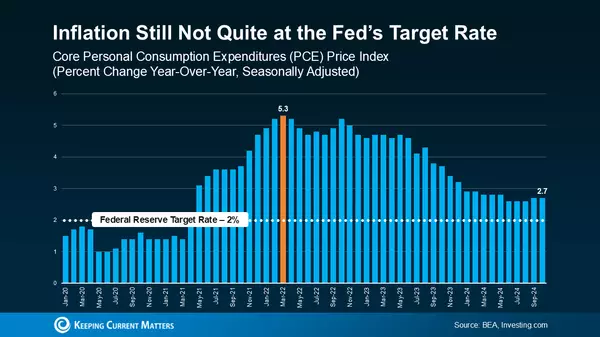

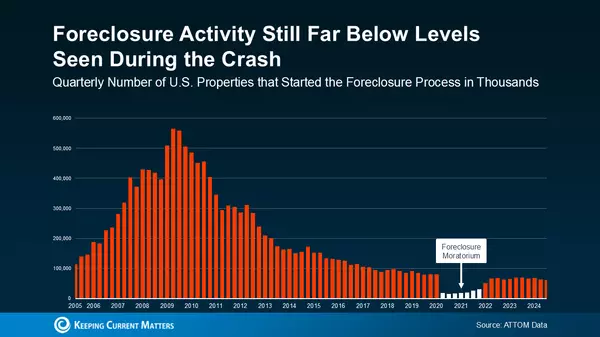

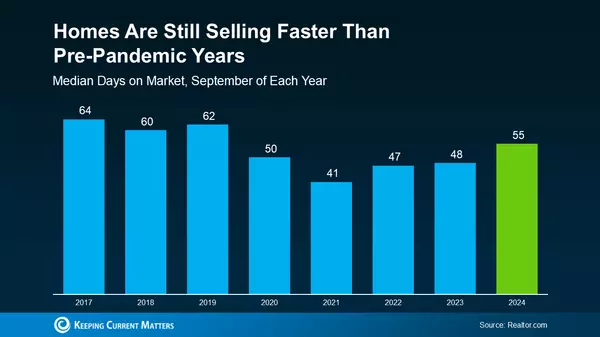

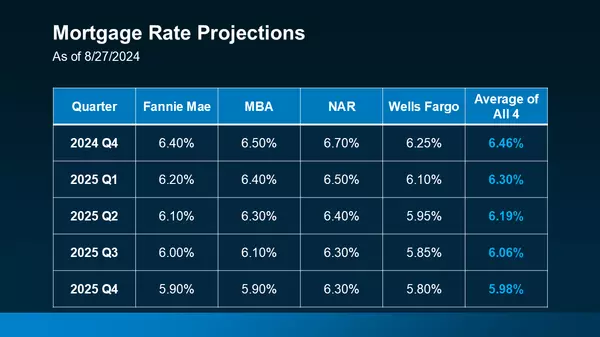

Looking ahead to 2025, it's crucial to understand what experts are predicting for the housing market. Whether you're thinking about buying or selling a home next year, having a clear picture of the market outlook can help you make the best decisions for your homeownership goals. 🏡✨ Here's a sneak peek at the most recent projections on mortgage rates, home sales, and prices for 2025. Mortgage Rates Are Projected To Come Down Slightly 📉 Mortgage rates play a significant role in shaping the housing market. According to forecasts from Fannie Mae, the Mortgage Bankers Association (MBA), the National Association of Realtors (NAR), and Wells Fargo, we can expect a gradual decline in mortgage rates throughout the next year. Why the expected drop? It’s largely due to the easing of inflation and a slight rise in unemployment rates—key indicators of a strong but slowing economy. Many experts believe these signs will encourage the Federal Reserve to lower the Federal Funds Rate, which typically leads to lower mortgage rates. As Morgan Stanley puts it: “With the U.S. Federal Reserve widely expected to begin cutting its benchmark interest rate in 2024, mortgage rates could drop as well—at least slightly.” Expect More Homes To Sell 🏘️ The market is likely to see an increase in both the supply of homes available and a rise in demand, as more buyers and sellers who’ve been holding off due to higher rates decide it’s time to make a move. This is one of the main reasons why experts are predicting an increase in home sales next year. According to Fannie Mae, MBA, and NAR, total home sales are expected to rise slightly, with around 5.4 million homes projected to sell in 2025. That’s a modest increase from the lower sales numbers we’ve seen in 2023 and 2024. For perspective, about 4.8 million homes were sold in 2023, and expectations are for approximately 4.5 million homes to sell this year. While slightly lower mortgage rates may not cause a massive surge in buyers and sellers, they will likely encourage more activity in the market. This means more homes available for sale and healthy competition among buyers eager to make a purchase. Home Prices Will Go Up Moderately 📈 As more buyers jump into the market, we'll see continued upward pressure on prices. According to the latest price forecasts from 10 trusted real estate sources, home prices are expected to rise nationally by an average of 2.6% next year. Although there’s a range of opinions on how much prices will climb, experts agree that home prices will continue to increase moderately in 2025 at a slower, more sustainable rate. Keep in mind, however, that prices will always vary by local market. Bottom Line 💬 Understanding the housing market forecasts for 2025 can help you plan your next move with confidence. Whether you're buying or selling, staying informed about these trends ensures you make the best decision possible. If you’re ready to discuss how these projections might impact your plans, contact Krista Klause and her team—they’d love to help! 😊📞 Let's make 2025 your best year yet in real estate! 🎉

Read More

Mortgage Rates Are Dropping: Is Now the Time to Buy?

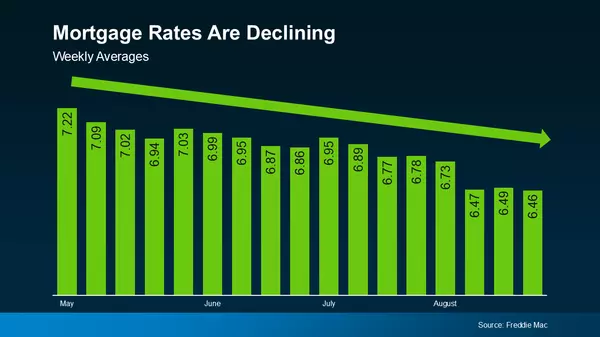

You won’t find anyone who’s going to argue that mortgage rates have had a big impact on housing affordability over the past couple of years. But there is hope on the horizon! Rates have actually started to come down, and recently, they hit the lowest point we’ve seen in 2024, according to Freddie Mac. 📉 If you’re thinking about buying a home, you might be wondering: how much lower are they going to go? Here’s some info to help you know what to expect. Expert Projections for Mortgage Rates 📊Experts say the overall downward trend should continue as long as inflation and the economy keep cooling. But expect some ups and downs as new reports come out. The key is not to get distracted by the blips—focus on the larger trend. Rates are down roughly a full percentage point from the recent peak in May, and many experts believe rates in the low 6s are possible in the months ahead. Most experts are even revising their 2024 mortgage rate forecasts to be more optimistic. For instance, Realtor.com now expects a yearly mortgage rate average of 6.7%, with a year-end forecast of 6.3%. Know Your Number for Mortgage Rates 🔢What does this mean for you and your plans to move? If you’ve been holding out and waiting for rates to come down, know that it’s already happening. The question is: what number are you comfortable with? Maybe it’s 6.25%, 6.0%, or even 5.99%. Once you have that number in mind, you don’t need to follow rates yourself—let me do that for you! I’ll keep you updated on the latest trends and let you know when it’s time to make your move. Bottom Line 🏠If higher mortgage rates have put your moving plans on hold, now’s the time to think about the rate that would bring you back into the market. Once you have that number in mind, reach out to Krista Klause, your trusted go-to Realtor, and I’ll be by your side to help you navigate the journey. Contact my team and me, and we’ll be happy to assist you! 😊✨

Read More

Avoid the Costly Mistake of Overpricing Your Home

In today’s housing market, many sellers are making a critical error: overpricing their homes. This mistake can leave your property sitting on the market without offers, ultimately forcing you to lower your price. And when that happens, you lose valuable time and potentially money. 📉 What’s Happening? Data from Realtor.com shows more and more homeowners are realizing this mistake and reducing their prices. If you’re planning to sell, here’s why working with Krista Klause, your trusted realtor, is crucial in avoiding this pitfall. 1. Ignoring Current Market Conditions 📊The market has changed significantly since the pandemic, and pricing your home based on outdated conditions is a mistake. Krista stays updated on the latest trends, ensuring your home is priced accurately for today’s market. 2. Pricing for Profit, Not for Market Value 💸Setting your price based on what you want to make, rather than what the home is actually worth, can be disastrous. Even if similar homes in your neighborhood are selling for top dollar, you may not be considering key differences like size, condition, or features. Krista will conduct a detailed comparative market analysis (CMA) to determine your home’s true market value. 3. Pricing High to Allow for Negotiation 🎯Some sellers price their homes high with the idea of negotiating down, but this strategy can backfire. A high price tag can scare off potential buyers, leading to fewer offers and possibly none at all. As U.S. News Real Estate points out, overpriced homes often end up needing a price cut, but by then, the prime time for attracting buyers has passed. Krista will help you set a fair price that attracts interest and encourages competitive offers. Bottom LineOverpricing your home can have serious consequences. Working with Krista Klause means you’ll benefit from an objective, strategic approach to pricing, ensuring your home sells for what it’s truly worth. Connect with Krista today to avoid the pricing mistake that could cost you dearly. 🔑

Read More

Categories

Recent Posts