The Best Time to Buy is Almost Here!

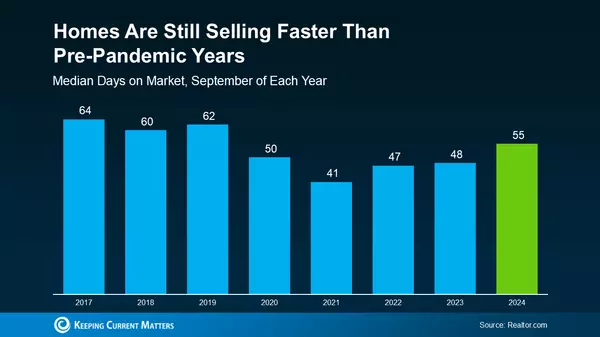

A shift is happening in the housing market, and now may be the perfect moment to jump back into your home search. According to Realtor.com, the best week to buy in 2024 is Sept. 29–Oct. 5. During this time, inventory is up, prices are below peak levels, and buyer demand is cooling, which means less competition for you! 📉 Why is This Week Special? Mortgage rates just hit their lowest point in 19 months, making homes more affordable. As Andy Walden from ICE says, the recent drop in rates has brought much-needed relief to homebuyers, making August the most affordable month since February. Additionally, Ralph McLaughlin of Realtor.com notes that inventory is up by 35.8%, giving you more options to find the right home. 🏠 What Does This Mean for You? With more homes on the market and motivated sellers eager to negotiate, you could find yourself in the perfect position to secure a great deal! Lower interest rates and a larger pool of homes to choose from make this fall a prime time to buy. ✨ Bottom Line: If you’ve been waiting for the right time to buy, Krista Klause and her team are ready to help you take advantage of this opportunity. Reach out today, and let’s get you off the sidelines and into your dream home! 😊📞

Read More

What’s Really Happening with Home Prices?

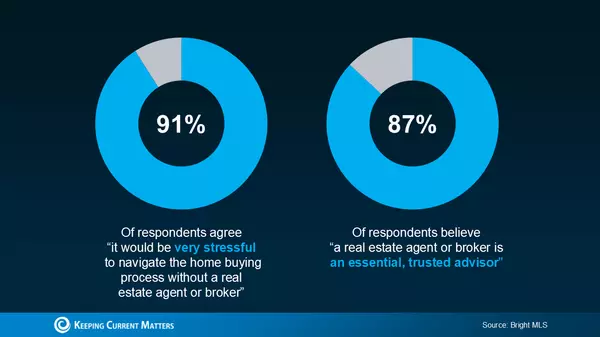

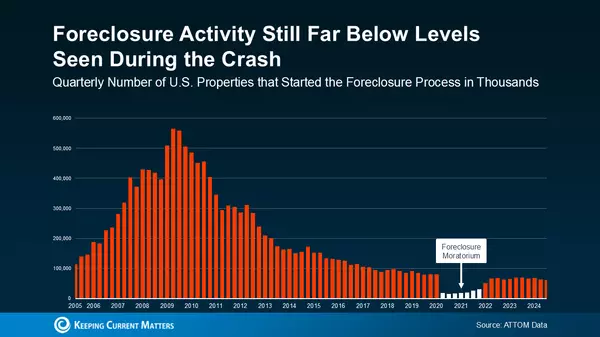

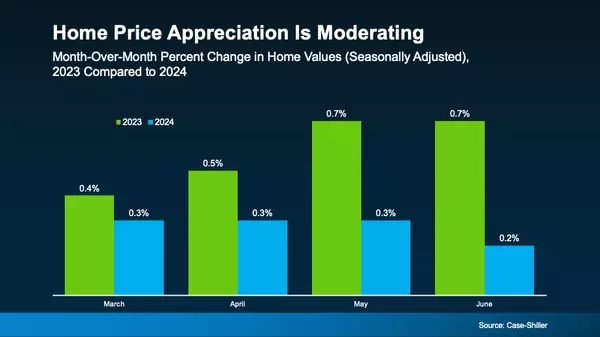

If you’ve been wondering about home prices lately, you’re not alone! With all the buzz out there, it can be hard to figure out your next move. 🤔 As a buyer, you might be worried about overpaying, and as a seller, you could be concerned about not getting your ideal price. Let’s break down what’s really going on with prices to help you make the right decision. Home Price Growth Is Slowing, But Prices Aren’t Dropping Across the country, home price appreciation is slowing down—meaning prices are still rising, just not as fast as in recent years. But don’t worry, this doesn’t mean home prices are dropping! The market is cooling, but prices are still on the rise, just at a more manageable pace. 📈 What’s Next for Home Prices? It’s All About Supply and Demand Where home prices go from here depends on supply and demand, and this can vary by local market. While the number of homes for sale is increasing, there still aren’t enough to fully meet buyer demand, keeping pressure on prices. As Danielle Hale, Chief Economist at Realtor.com, says: “. . . today’s low but quickly improving for-sale inventory has ushered in more market balance than would otherwise be expected. . . This should help home prices maintain a slower pace of growth.” Plus, with experts predicting a continued drop in mortgage rates, more buyers may enter the market soon, which could push prices even higher. 📉🏠 Why Work with a Local Real Estate Agent? National trends offer a broad view, but real estate is local. What’s happening in your neighborhood could be very different from the national average, depending on supply and demand in your market. That’s why working with a local expert like Krista Klause, your trusted realtor, is so important. Whether you’re buying or selling, Krista and her team can give you the latest data and help you make the best decision for your unique situation. They’ll help you price your home accurately or find the perfect property that fits your budget. Bottom Line Home prices are still rising, just at a slower pace. Whether you’re buying, selling, or just curious about your home’s value, reach out to Krista Klause and her team today for expert advice and personalized guidance! 😊📞

Read More

September Shift: What a Fed Rate Cut Means for You and the Housing Market!

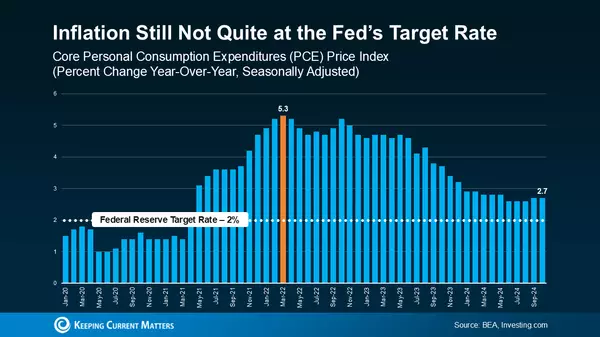

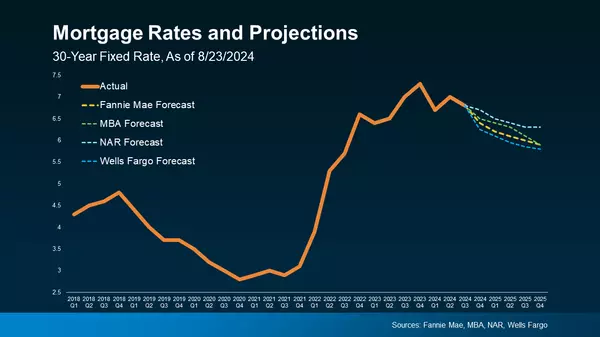

As September rolls in, all eyes are on the Federal Reserve (the Fed). With inflation cooling and the job market slowing, many expect a cut to the Federal Funds Rate at their upcoming meeting. Mark Zandi, Chief Economist at Moody’s Analytics, believes they’re ready: “They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.” But what does this mean for the housing market and, more importantly, for you as a potential homebuyer or seller? Why a Federal Funds Rate Cut Matters The Federal Funds Rate influences mortgage rates, along with other factors like the economy and geopolitical events. When the Fed cuts this rate, mortgage rates often respond. While one cut might not cause a dramatic drop, it could contribute to the gradual decline already underway. Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), explains: “Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.” And this likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), suggests: “Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.” The Impact on Mortgage Rates Experts project that mortgage rates will continue to decline gradually through 2025, partly due to anticipated Fed cuts. Here’s why this is good news for buyers and sellers: Easing the Lock-In Effect: For current homeowners, lower mortgage rates could ease the lock-in effect, where higher rates make people hesitant to sell. A slight rate reduction might make selling more attractive, though it’s unlikely to flood the market with sellers. Boosting Buyer Activity: For potential homebuyers, lower rates make homeownership more affordable, potentially encouraging more people to enter the market. What Should You Do? While a Fed rate cut is unlikely to lead to drastically lower mortgage rates, it’s a step in the right direction. However, as Jacob Channel, Senior Economist at LendingTree, wisely notes: “Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.” Bottom Line The expected Fed rate cut, driven by improving inflation and slower job growth, is likely to have a gradual positive impact on mortgage rates, unlocking opportunities for you. When you’re ready to explore your options, connect with Krista Klause and her team to make informed decisions and take action! 😊📞

Read More

Is It Time to Sell? Let Your Lifestyle Be the Guide!

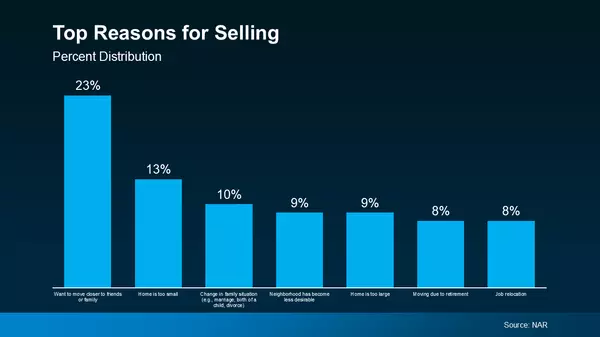

Are you on the fence about whether to sell your house now or wait? It’s a common dilemma, but here’s something important to consider: your lifestyle might be the biggest factor in your decision. While finances matter, personal reasons for moving could be enough to make the leap sooner rather than later. 🏡✨ An annual report from the National Association of Realtors (NAR) sheds light on why homeowners decide to sell, and all the top reasons are tied to life changes. The biggest motivators include the desire to be closer to friends or family, outgrowing their current house, or experiencing significant life events like getting married or having a baby. Downsizing or relocating for work also made the list. 👨👩👧👦📦 If you’re in a similar situation, needing features, space, or amenities that your current home can’t provide, it might be time to consider selling. Your needs matter, and Krista Klause, your trusted realtor, can walk you through your options and what to expect from today’s market. This will help you make a confident decision based on what’s most important to you and your loved ones. 💬 Krista can also help you understand how much equity you have and how it can make moving easier. As Danielle Hale, Chief Economist at Realtor.com, points out: “A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.” Bottom Line Your lifestyle needs might be the motivation you need to make a change. If you want help weighing the pros and cons of selling your house, contact Krista Klause and her team for more information about the market. We’re here to help you make the best decision for your future! 😊📞

Read More

Categories

Recent Posts